Last updated on May 12th, 2025 at 10:50 am

Example of HSBC Equity Release Under 55 for a UK property owner

Property Valuation: 186000

Mortgage Amount: 120900

Loan To Value: 65%

Rate: 4.16% Fixed

Valuation Fee: Free

Lender Fees: None

Does HSBC do Equity Release?

Yes, HSBC does equity release at 1.8% APRC. HSBC Equity Release can have a loan to value of 60%.

Does HSBC do Equity Release Under 55?

Yes, HSBC Equity Release Under 55 is 1.91% MER.

Later Life Interest Only Mortgage

Does HSBC offer Retirement Mortgages?

Yes, HSBC Retirement Mortgages are 2.07% APRC.

Does HSBC do Pensioner Mortgages?

Yes, HSBC Pensioner Mortgages are 1.94% MER.

Best Equity Release Rates HSBC

Does HSBC do Equity Release?

Yes, HSBC Equity Release is 2.12% APR.

What are HSBC interest rates for equity release?

HSBC rates for equity release are 2.14% APRC.

Does HSBC have favourable reviews for equity release?

Yes, HSBC reviews are splendid for equity release.

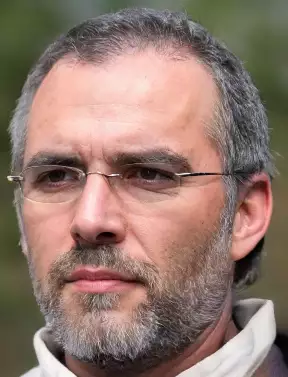

Later Life Mortgages from HSBC UK

Does the HSBC equity release calculator show the LTV?

Yes, the HSBC equity release calculator shows a favourable LTV of 65%.

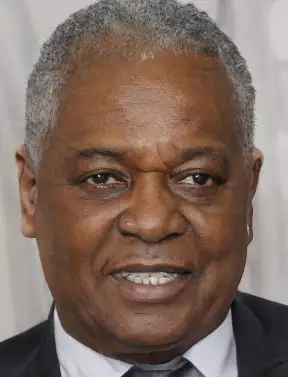

Mortgages For Over 50 Year Olds from HSBC UK

Does an HSBC equity release advisor charge a hefty fee?

No, HSBC equity release advisors are free.

Hard-to-mortgage home variants include properties currently undergoing substantial alterations, extensions, or repairs, properties where tenants live in a self-contained part of the property, right–to–buy properties in Scotland, properties where the customer is offering only part of the title as security for the loan, and freehold flats (England, Wales, Northern Ireland).

Does HSBC offer home equity loans?

Yes, HSBC home equity loans are 2.22% APRC.

Popular loan-to-value percentages of Aviva interest-only mortgages for people over 60, Zurich equity release deals for people over 70, Sainsbury’s lifetime mortgages for people over 55, Skipton Building Society interest-only lifetime mortgages for over 60s, Nottingham Building Society later life interest-only mortgages over 60, and Progressive Building Society interest-only mortgages for over 60s near London are 50%, 60%, and 65%.

An Interest-Only Lifetime Mortgage is a great way to unlock the money tied up in your home for your retirement.

Does HSBC offer home equity lines of credit?

Yes, HSBC home equity lines of credit are 2.01% APRC.

Some of the most popular LTV ratios of Liverpool Victoria are mortgages for over 50-year-olds, More 2 Life remortgages for people over 50 years old, One Family later life borrowing schemes over 55, YBS interest-only mortgages for people over 70, Principality Building Society equity release schemes for over 55’s and SunLife mortgages for people 60 plus are 50%, 55% and 70%. Low rate, no fee Mortgages For Over 60S are good for people that are struggling with the cost of living for basic necessities.

How much money can I borrow with HSBC equity release under 55?

You can achieve 65% of your home’s valuation. For example, if your home is worth £340000, you can borrow £221000.

Popular loan to values of Lloyds lifetime mortgages for over 55s, Barclays Bank later life interest-only mortgages over 60, Halifax interest-only mortgages for over 60s near London, Legal & General interest only lifetime mortgages for over 70s, Bank of Scotland interest-only mortgages for over 60s and Nationwide BS later life interest-only mortgages over 75 are 35%, 55% and 70%. Another very common product is Interest Only Mortgages For Over 60s because people’s gas and electricity bills are very high.

Many of the most appealing retirement loan offerings include Lloyds Bank mortgages for over-60s, Barclays Bank later life borrowing schemes, Halifax interest-only mortgages for over 70s, Legal and General retirement mortgages, and Nationwide Building Society mortgages for over 65. Another good product is Interest-Only Mortgages For Over 70s because people are struggling with the cost of living.

Hard-to-finance property variants can include timber-framed properties built before 1920, timber-framed properties built between 1920 and 1965, studio flats located within the M25, studio flats outside the M25, and flats above or adjacent to commercial premises. HSBC equity release under 55 has a free valuation.

Tough-to-finance property variants include properties with land in addition to the domestic grounds up to a maximum property size of five acres, where the land is for normal domestic use, properties with a large number/scale of outbuildings, use of the land and any outbuildings for a small amount of personal commercial use., properties with mobile phone masts which are not within influencing distance of the house and properties that have a private water supply provided a contract is in place with an approved maintenance company for regular testing and maintenance.

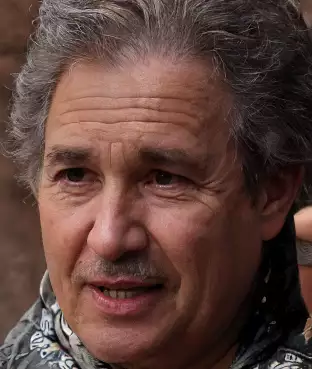

HSBC Equity Release Under 55 with a cash reserve

This equity release product has a free valuation and no broker fees.

Tough-to-mortgage property titles can include properties that will be assessed for flood risk, properties with high service charges—where the Service Charge per annum at the time of application is more than 2% of the property value—and properties with structural problems, asbestos construction, and concrete panel houses.

What is the minimum age for equity release?

Some lenders do not have a minimum age for equity release. It just depends on how much home equity you have to release.

Can you release equity at 53?

Yes, and in 2022 the rates are still very low.

What does Martin Lewis think of equity release?

He has said you should use it cautiously.

What are the pitfalls of equity release?

The pitfalls are the roll-up interest. You end up paying interest on the interest as there are no monthly payments to support the interest in real time.

Is there a maximum age for Equity Release?

No, there are no maximum age criteria for equity release from some lenders.

How long does equity release take?

You can have the funds in as little as 15 working days, subject to the valuation of your home.

What is equity release?

It is a loan secured on a home, usually your main residence, for which you do not have to make monthly repayments.

How does an equity release mortgage work?

You pick the product that suits you best, you get your home valued, you sign the papers, and then the money is released to your bank.

https://www.moneyhelper.org.uk/en/homes/buying-a-home/what-is-equity-release